Managing sick leave effectively is critical for small businesses to ensure compliance with laws, maintain productivity, and support employee well-being. In the United States, sick leave policies are influenced by federal, state, and local regulations, with the Family and Medical Leave Act (FMLA) serving as a foundational framework. This guide explores the legal requirements and best practices for small businesses to navigate sick leave policies effectively.

The United States federal government requires unpaid leave for serious illnesses through the Family and Medical Leave Act (FMLA), which provides up to 12 weeks of unpaid, job-protected leave for eligible employees. However, the FMLA does not cover short-term illnesses, leaving states to address this gap through an increasing number of paid sick leave mandates. These state laws ensure workers have access to paid time off for short-term health needs, creating a crucial distinction from the unpaid benefits provided by the FMLA. Some jurisdictions also allow "safe leave," which enables employees to use sick leave for health and safety reasons related to domestic violence, sexual assault, stalking, and other forms of harassment.

For small business owners, understanding the nuances of unpaid FMLA leave versus state-mandated paid sick leave is essential to ensure compliance and provide adequate employee support.

Check on How TimeOff.Management Tracks Sick Leave.

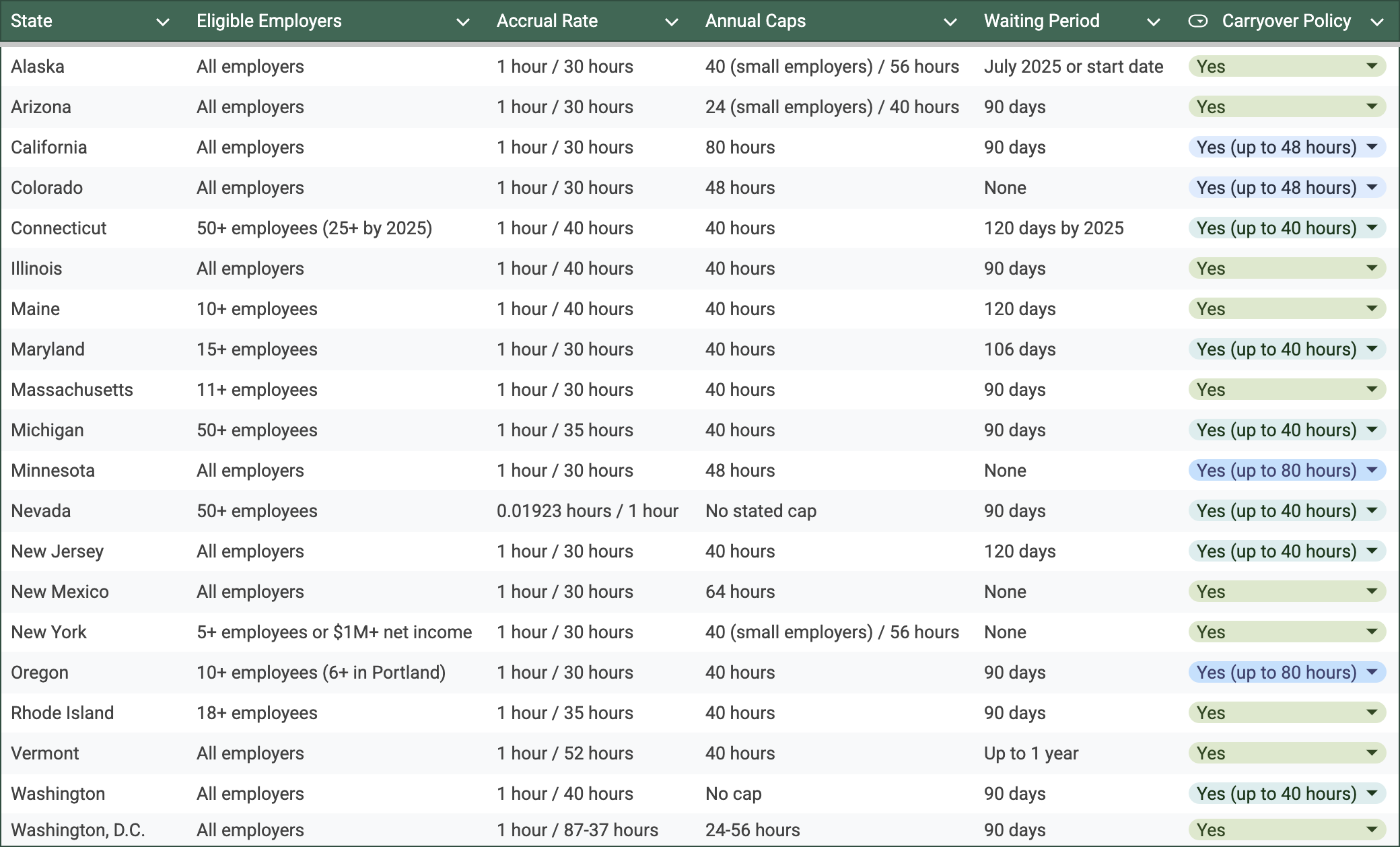

The following states require employers to provide paid sick leave. Each law varies in terms of accrual rates, usage limits, and employer size thresholds. Here’s a breakdown:

While compliance with legal mandates is non-negotiable, offering robust paid sick leave policies can have additional benefits for your business:

While compliance with the law is mandatory, going beyond the minimum requirements can enhance employee satisfaction and reduce absenteeism. Here are some best practices:

Create a detailed sick leave policy that outlines accrual, usage, and reporting procedures. Clearly communicate this policy to all employees during onboarding.

Employ software solutions like TimeOff.Management to streamline the tracking of sick leave balances, approvals, and carryover calculations.

Train your management team to handle sick leave requests professionally and empathetically, ensuring compliance with laws and promoting workplace trust.

Consider front-loading sick leave or offering a combined paid time off (PTO) policy for simplicity and employee flexibility.

Stay updated on state and local laws to ensure your business remains compliant, particularly if you operate across multiple jurisdictions.

Q: What is the difference between FMLA and state-mandated sick leave?

A: The FMLA provides up to 12 weeks of unpaid, job-protected leave for serious health conditions. State-mandated sick leave offers paid time off for short-term illnesses and other specific needs.

Q: Can I combine sick leave with PTO?

A: Yes, many businesses combine sick leave with vacation and personal time into a single PTO bank for simplicity. Ensure your policy meets or exceeds the requirements of applicable state laws.

Q: Do I need to offer paid sick leave if my business operates in multiple states?

A: Yes, you must comply with the laws of each state in which your employees work. Use centralized tools to manage varying requirements efficiently.

Sick leave policies are more than a legal obligation—they reflect a company’s commitment to its employees' health and well-being. As state-mandated paid sick leave laws continue to expand, staying informed and proactive is crucial. By implementing best practices and leveraging modern tools, small businesses can not only remain compliant but also foster a supportive and productive work environment.